Solana Fees + Burn Tracker: Last 24 hours

💰 9,647.283 SOL

Fees (24h)

💡 985.372 SOL

Jito Tip Revenue (24h)

🎫 0.000114949 SOL

Average Non Vote Fee (24h)

👟 70.24%

User Txns paying priority (24h)

Where Does Solana Block Revenue Go?

note: this illustration assumes a standard jito tip commission of 10%, some validators may charge more or lessIn the last 24 hours Jito tips made up 9.9% of block revenue, while priority fees were 46.1%. The majority of public validators set a commission on Jito tips of 10%. This means in most cases stakers will receive 8.4% of total block revenue, while validators get 69.1%. Jito DAO take a 5% share of tips so receive 0.5% of total block revenue, and 22.0% is burned.

Total Solana Fee Volume

How much is Solana generating in user fee revenues each epoch?

In the last epoch Solana generated a total of 38,028.91 SOL in fees from user - ie non vote - transactions. A 'user' in this case includes any Solana wallet, exchange, or application that is not a validator.

How much is Solana generating in total fee revenue each epoch?

In the last epoch Solana generated a total of 28,030.34 SOL in fees from all network transactions. This figure includes fees paid by validators to participate in consensus by voting. That's roughly 11,212.13 SOL per day!

This fee revenue is shown broken down into three main sources - the vote fees from validators, the base fees paid on every transaction, and the priority fees paid.

Average Fees & Priority Fee Usage

How do fees and Jito tip amounts compare?

This chart shows the average and median fee paid by non-vote transactions (using avg_extra and med_extra) alongside the average and median Jito tip values (jito_avg_tip, jito_med_tip) for each epoch.

What is the average transaction fee paid by a Solana user?

The average transaction fee paid by Solana's users in the last epoch was 0.000106110 SOL. This was the average fee paid on all transactions that are not vote transactions, including priority fees. Many transactions would have paid the minimum fee of 0.000005 SOL, but some would have paid more to guarantee priority processing of their transactions/.

Showing the average fee a network user paid during each epoch, excluding vote transactions. A user in this case could be a browser wallet or a trading bot: most human users pay low to no priority fees, while trading bots bring the average up by paying extra to ensure their trades land on time.

What is the average transaction fees across all Solana transactions?

The average transaction fee paid by Solana's users in the last epoch was 0.000048462 SOL. This was the average fee paid on all transactions, including vote transactions, and including priority fees.

Showing the average fee paid by all transactions on the Solana network, for each epoch. Since validator vote transactions pay a fixed fee this is less representative of fees network users are paying

How many user transactions are paying priority fees?

In the last epoch, 71.00% of user transactions were paying priority fees.

This chart shows what percentage of non-vote transactions elected to use a priority fee. In this case - as for all metrics on the page - a fee is considered 'priority' when it exceeds the 0.000005 SOL base fee. This means even a tiny tip (eg a fee of .000005001) is included.

What is the average priority fee paid by Solana users?

In the last epoch, Solana users paid an average priority fee of 0.000074617 SOL.

The average priority fee shows on average how much in total a non-vote transaction with a priority tip or 'bump' is paying to be included in a block. It includes the .000005 SOL base fee.

Solana Burned Over Time

How much Solana is burned each day?

Did you know 50% of all Solana base fees are burned? In the last epoch Solana burned 1,544.51 SOL. Each epoch lasts around 2 days, so that is roughly 772.26 SOL per day!

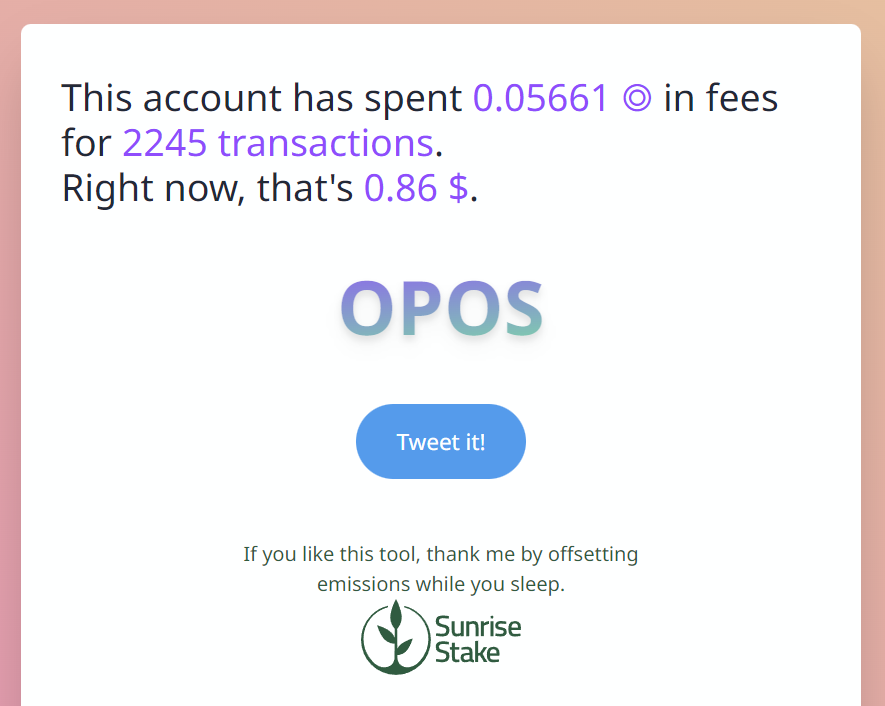

How much have *you* paid in fees?

Want to know how much you've personally spent on fees?

SolFees.FYI is a great tool by @ronnyhaase that will scan your account's transactions and calculate how much you've spent on fees in total.

Why Are Solana's 'Gas' Fees For Transactions So Low?

Published on 2020-10-06

Transaction fees vary between coins, depending on two key factors: the time required to generate new blocks on the blockchain and the number of transactions that a single block can handle.

How Much Are Transaction Fees on Solana vs. Ethereum?

Transaction fees in cryptocurrency refer to the charges a user pays when transferring crypto coins from one account to another. Before a transaction can pass or be recorded in the blockchain, it’ll require a certain fee.

Cryptocurrencies generally have three types of transaction fees:

- Network fees

- Wallet fees

- Crypto exchange fees.

Transaction fees vary between coins, depending on two key factors: the time required to generate new blocks on the blockchain and the number of transactions that a single block can handle. Solana has better block time (0.4 seconds) and block size (20,000 transactions) than Ethereum (block time: 13 seconds, block size: 70 transactions).

The higher block time and block size are why the Solana network offers an incredibly low transaction fee of just $0.00025 per transaction. This price makes Solana one of the blockchains with the cheapest transaction fees. In contrast, Ethereum, which is Solana's primary competitor, currently charges an average transaction fee is between $3-10 in September 2021. This fee can fluctuate dramatically depending on transaction volume across the network, and it is not uncommon to see complaints on social media about gas fees of as much as $50 or $100, even for minor transactions.

With numbers like those, Solana should climb higher than 50,000 TPS without any difficulty. That is about equivalent to what VISA is capable of, according to bitcoin.com.

Solana is rapidly growing in CPU and other technologies and promises to double its scalability every two years. If the network can achieve this, the transaction fees will remain cheap and may even fall since competition for block-space falls.

In contrast, Ethereum has not shown any surprises as the transaction fees skyrocket as use increases. The abysmal nature of the Ethereum blockchain has resulted in intense pressure for block-space. Hopefully, Eth 2.0 will change this narrative.

The new Ethereum version will ultimately expand the Ethereum blockchain to accommodate millions of transactions per second, reducing transaction fees and considerably increasing transaction speed.

Related Content

Solana Changelog - Token Extensions and Transaction Size Fees

Explore Solana's latest developments including token extensions, transaction size fees, and the upcoming Mountain Dew 5 event in this comprehensive changelog.

WTF RPC? w/ Brian Long (Triton One)

Dive deep into the world of RPC services with Brian Long from Triton One. Explore how RPCs enhance blockchain usability, data retrieval, and transaction processing on Solana and beyond.

Everything You Need To Know About Solana Blinks | Chris Osborn & Jon Wong

Discover how Solana Blinks are transforming crypto interactions on social media, enabling seamless transactions and actions directly from platforms like Twitter.

Worldpay's Neil Kreisel on USDC Integration and Blockchain Payments

Learn how Worldpay is integrating USDC and blockchain technology to revolutionize global payment processing, offering faster settlements and reduced costs.

Solana Changelog - Faster Transactions, Stake-Weighted QoS, and Compute Optimization

Discover the latest Solana updates including faster transaction processing, stake-weighted quality of service, and new developer tools for compute optimization and Web3.js integration.

Solana Changelog - Token Extensions and Transaction Size Fees

Discover the latest Solana updates including token extensions, transaction size fees, and developer resources in this comprehensive changelog.

Solana Changelog - Jan 30: Transaction CU Cost, Simulation for Token Accounts, and Fee for Write Lock

Discover Solana's latest improvements including transaction cost tracking, token account simulation, and a proposal for write lock fees to enhance network efficiency.

Why Are Solana Transactions Dropping? | Mert Mumtaz, Dan Smith

Explore Solana's network issues, dropped transactions, and potential solutions with experts Mert Mumtaz and Dan Smith in this insightful Lightspeed podcast episode.

Lightspeed: Blinks - The Future of Internet Interactions

Discover how Solana's Blinks are transforming online interactions, combining blockchain and traditional web technologies to create a more dynamic and secure internet experience.

Breakpoint 2023: ExplorerKit: The Future Standard of Parsing?

Breakpoint 2023 explores the feasibility of ExplorerKit as the new industry standard for parsing blockchain transactions, events, and more.

Breakpoint 2023: Stablecoins: The New Bridges Between On- and Off-Chain

An insight into how stablecoins, like Your E, are becoming the essential connectors for financial transactions within and outside the blockchain ecosystem.

Raoul Pal's Thoughts on Inflation vs Deflation | Superteam Clips

Real Vision co-founder Raoul Pal discusses the future of inflation, deflation, and the impact of technology on the global economy. Learn why he's bullish on risk assets and predicts a new golden age.

Breakpoint 2023: Simulation of Transaction Limitation

Exploring the intricacies and future developments in the field of cryptocurrency transaction simulations and limitations

Why Businesses Are Building On Solana | Baxus, Tzvi Wiesel

Discover how Baxus is transforming the wine and spirits industry using Solana blockchain technology, offering instant settlement, proof of presence, and DeFi integration for collectors and distilleries.

Blinks and Actions w/ Jon Wong (Solana Foundation) and Chris Osborn (Dialect)

Discover how Solana's Blinks and Actions are transforming blockchain interactions, enabling seamless transactions directly from social media platforms like Twitter.

- Borrow / Lend

- Liquidity Pools

- Token Swaps & Trading

- Yield Farming

- Solana Explained

- Is Solana an Ethereum killer?

- Transaction Fees

- Why Is Solana Going Up?

- Solana's History

- What makes Solana Unique?

- What Is Solana?

- How To Buy Solana

- Agent Permissions & Security

- AI Agent Financial Markets

- Solana Agent Skill

- Complete Sol CLI Guide

- AI Agent Prediction Markets

- x402 Agent API Payments

- Solana's Best Projects: Dapps, Defi & NFTs

- Choosing The Best Solana Validator

- Staking Rewards Calculator

- Liquid Staking

- Can You Mine Solana?

- Solana Staking Pools

- Stake with us

- How To Unstake Solana

- How validators earn

- Best Wallets For Solana